Trust And Estate Filing Services In Toronto

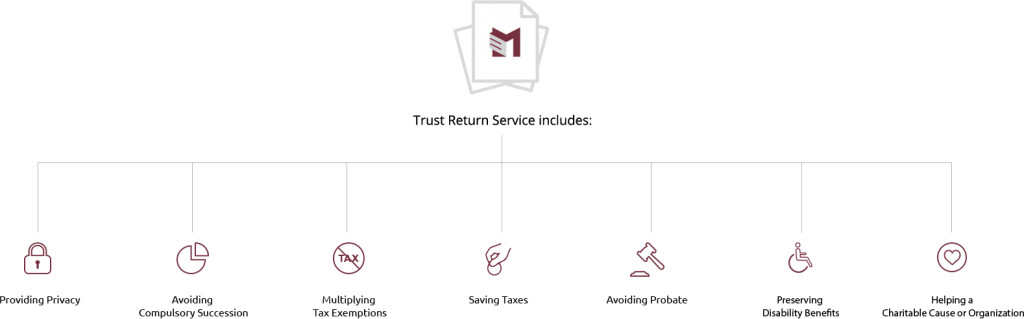

Ensure Estate and Trust filings are accurate, complete and timely to help protect your family assets.

Trusts

The most common form of Trust is a testamentary trust that is created by a will and takes affect after the passing of the deceased. All income earned after an individual pass is reported to the Canada Revenue Agency through a Testamentary trust return. Such income includes:

- Investment income (Interest and dividends)

- Capital Gain Income (Sale of assets such as Shares or property)

- Rental Income (from real estate owned by the deceased)

- Business Income (Income earned from business after passing away)

- Annuity settlements paid to the Estate

- CPP death benefits

There are 3 types of Testamentary Trusts:

- Graduated Rate Estate (GRE)- These trusts are taxed at the same rate as any other individual tax rates. These rates are effective for 36 months after the persons passing. If all assets are not distributed among the beneficiaries within this period then any income earned by the estate, it will be taxed at the highest rate.

- Qualified Disability Trust (QDT)- Is a testamentary trust that qualifies for the lower tax rates as long as the electing beneficiary qualifies for the Disability Tax Credit and is the only beneficiary of the trust. Also the electing beneficiary cannot be a beneficiary of multiple Qualified Disability Trusts.

- All other Testamentary Trusts (OTT)- As of January 1, 2016 all income earned in these trusts will be taxed at the highest federal tax rate. Therefore it is advised to avoid having your estate surpass the 36 month time period before ceasing its Graduated Rate Estate classification.

CRA Representation

We can assist you with any of the following types of trusts:

- Testamentary Trust

A testamentary trust is created by a will and takes effect after the passing of the deceased by specifying how his/her assets are designated.

- Alter Ego Trust

A trust where the individual who created it (settlor), is entitled to receive all the income of the trust during his or her lifetime.

- Employee Trust

A trust established by an employer (grantor), with the employees listed as beneficiaries.

- Joint Spousal Trust

A trust where the individual who created it (settlor) and their spouse are entitled to receive all the income of the trust during both of their lifetime.

- Lifetime Benefit Trust

A trust where the surviving spouse or dependent is infirmed and was reliant on the deceased and is the sole beneficiary.

- Non-Profit Organization

is considered a trust, if the main purpose of the organization is to provide services to its members such as: dining, recreational or sporting facilities.

- Real Estate Investment Trust

trust that is a type of real estate investment – comparable to a mutual fund. It allows for small and large investments, as individuals can acquire ownership in real estate ventures through property and mortgages.

Canada revenue agency (CRA) requires all income earned in a trust to be reported annually through a T3 filing. We will guide you through the step-by-step process in obtaining the relevant information and disclosing it to the CRA. All trust filings and amounts owed are due 90 days after the trust’s tax year end.

Next Steps

Step 1

List all assets held by the trust which includes; (Real Estate, Securities, Bonds, Bank Accounts, and other investments)

Step 2

Determine the fiscal year of your Trust